pay my past due excise tax massachusetts

Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. THIS FEE IS NON-REFUNDABLE.

Massachusetts Marijuana Excise Tax Revenue Exceeds Alcohol For First Time

Pay my past due excise tax.

. Payment at this point must be made through our Deputy Collector Kelley. Get Tax Resolution in 3 Steps. WE DO NOT ACCEPT.

How do I pay my excise tax in Randolph MA. Get Your Tax Options With a Free Consultation. THIS FEE IS NON-REFUNDABLE WE DO NOT ACCEPT.

Get Tax Resolution in 3 Steps. Please note all online payments will have a 45 processing fee added to your total due. PAY YOUR BILL ON TIME.

Tax Title payments also accepted. Child Support Case Manager. Click on Motor Vehicle Excise Tax if you want further information concerning Excise Tax.

Avalara can simplify fuel energy and motor tax rate calculation in multiple states. Trusted Reliable Experts. How do I pay past due excise tax in Massachusetts.

Find your bill using your license number and date of birth. To make online payment of Motor Vehicle Excise Bills you MUST enter the Last name AND the Plate Registration number of the vehicle you need to pay. Please note all online payments will have a 45 processing fee added to your total due.

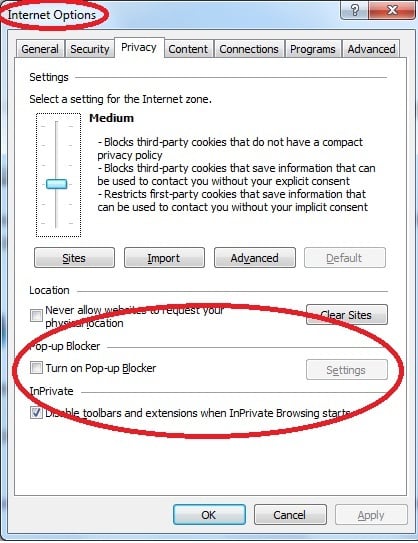

Ad Start with a Simple and Easy Free Consultation. How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal. Department of Revenue E-mail List Subscription.

Drivers License Number Do not enter vehicle plate numbers. We strongly encourage you to pay your Excise tax bills online or by dropping the check and bill in the outside dropbox on the circle driveway at. IF YOUR LICENSE IS SUSPENDED YOU MUST PAY WITH CASH OR MONEY ORDER Please use.

Real Estate and Personal Property tax bills for the 1st half of FY2022 were mailed out on October 29 2021 and were due November 29 2021. You may also Pay By Phone. Therefore it is the responsibility of the owner to contact the local assessor if heshe has not received a bill.

Ad A Rated in BBB. If you are unable to find your bill try searching by bill type. Ad Start with a Simple and Easy Free Consultation.

Water and sewer bills may be paid online through. Get Your Free Tax Analysis. All owners of motor vehicles must pay an excise tax.

Ad Avalara excise fuel tax solutions take the headache out of rate calculation compliance. Of Local Services Gateway. The tax will be delivered to the same address that.

Trusted Reliable Experts. Motor Vehicle Excise Tax bills are due in 30 days. Ad A Rated in BBB.

The tax rate is fixed at 25 per one thousand dollars of value. How do I pay overdue Excise Taxes that have. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less.

Water Sewer 2018 Excise Tax Commitments unless past due. All information provided on an excise tax bill. Analysis Comes With No Obligation.

Online Payment Search Form. This information will lead you to The State. The same convenience fees as online payments.

Get Your Tax Options With a Free Consultation. You pay an excise instead of a. Ad Avalara excise fuel tax solutions take the headache out of rate calculation compliance.

Ambulance Bills Effective January 1 2013. Analysis Comes With No Obligation. Massachusetts Motor Vehicle Excise Tax Information.

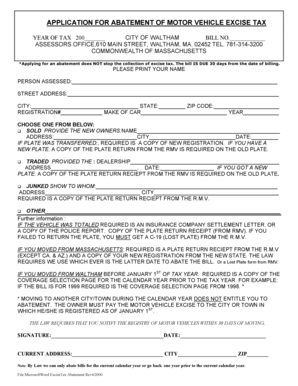

According to MGL excise bills must be mailed out 30 days before the due date thus providing 30 days for the principal balance to be paid. Pay Past Due Excise Tax Bills. If you dont make your payment within 30 days of the date the City issued the excise tax interest and fees are added to your bill.

Tax Delinquents Public Disclosure. If the bill goes unpaid interest accrues at 12 per annum. Avalara can simplify fuel energy and motor tax rate calculation in multiple states.

Get Your Free Tax Analysis. Online Payment Search Form NOTE. Nonpayment of a bill triggers a demand bill to be produced and a.

All information provided on an excise tax bill comes directly from the Registry of Motor Vehicles. All vehicles in the State of Massachusetts are subject to an annual motor vehicle excise tax.

Massachusetts Enacts Pass Through Entity Excise Tax For 2021 Calendar Year Marcum Llp Accountants And Advisors

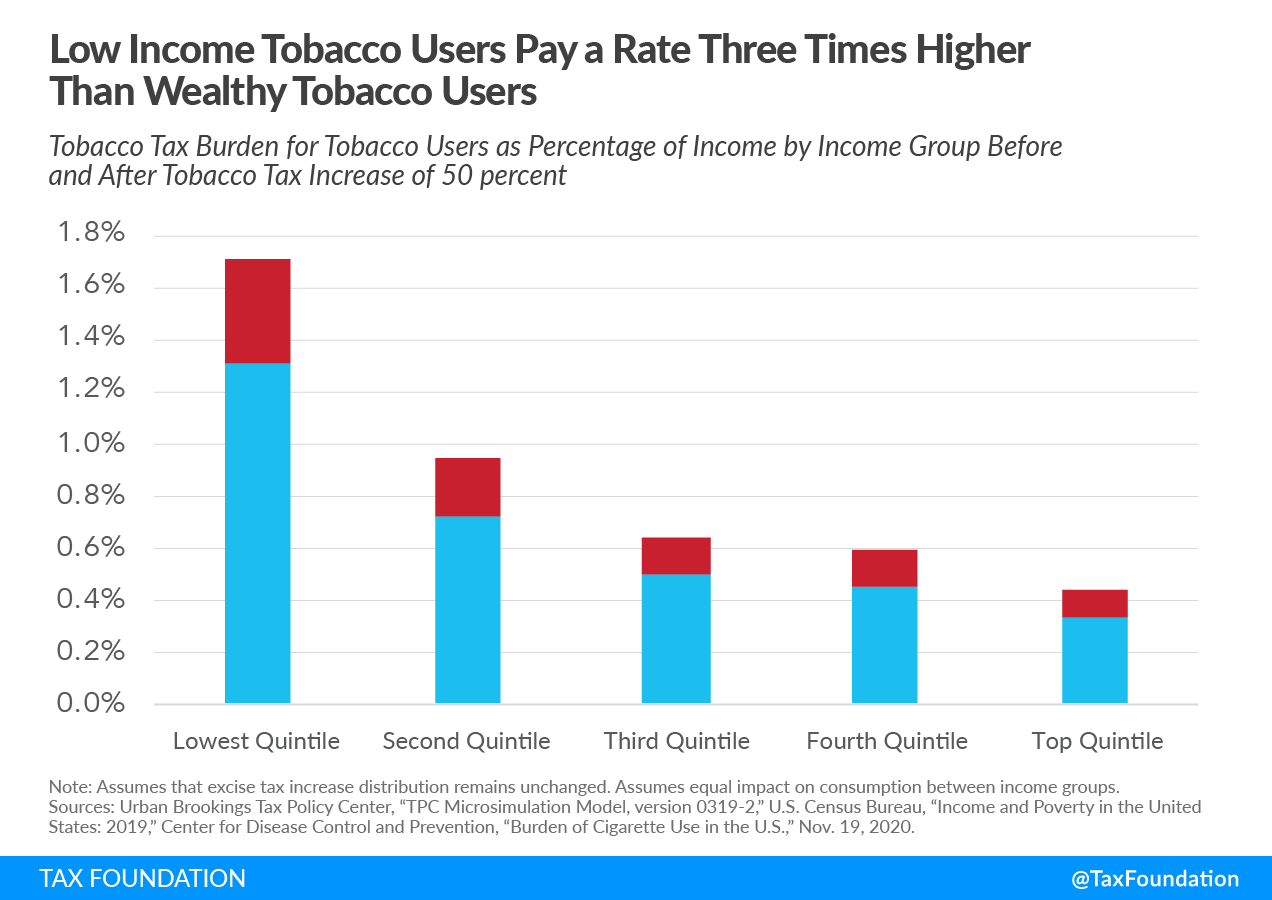

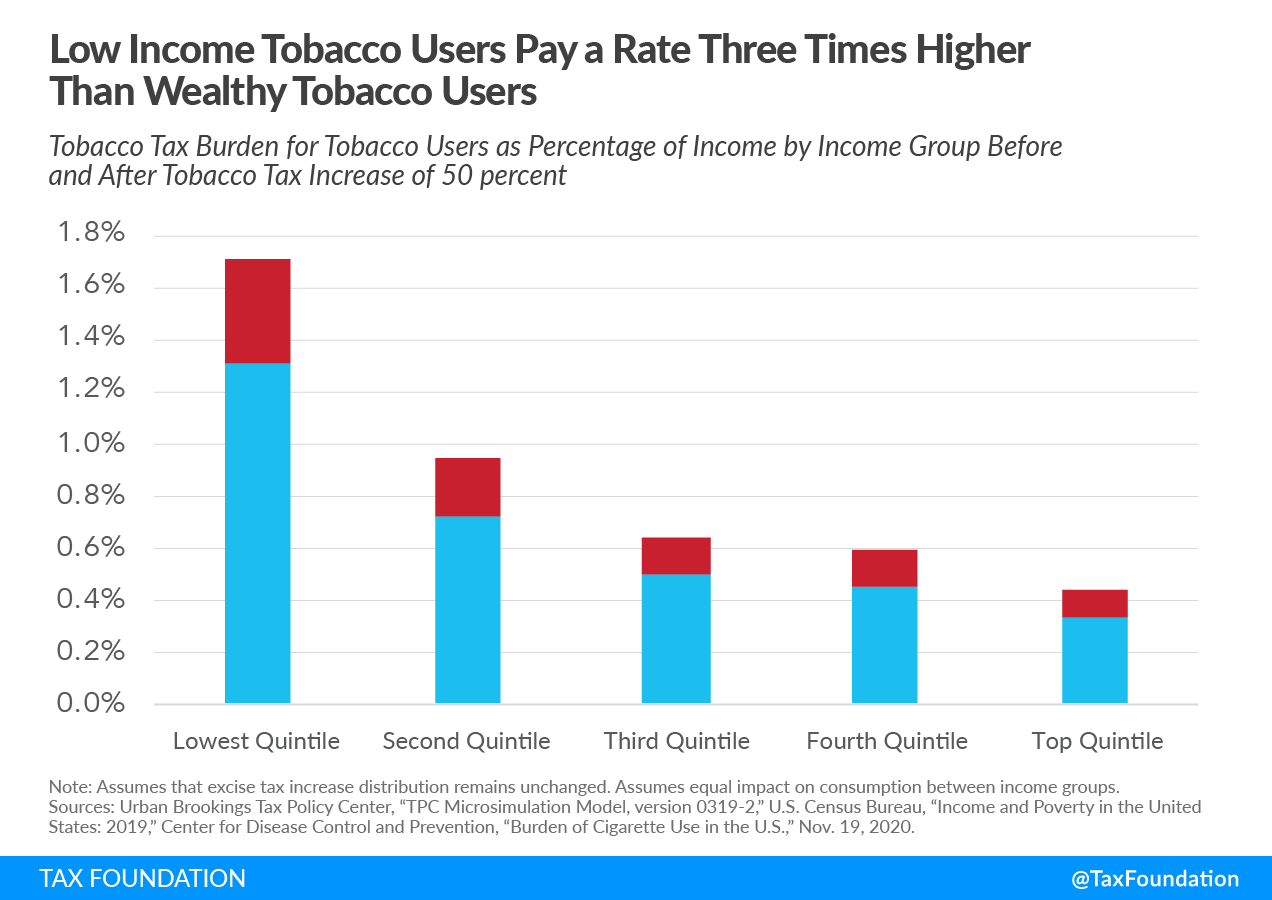

Excise Taxes Excise Tax Trends Tax Foundation

Online Bill Payments City Of Revere Massachusetts

Motor Vehicle Excise Tax Bills Gardner Ma

Motor Vehicle Excise Tax Bills Gardner Ma

2022 Motor Vehicle Excise Tax Bill Mailed Fairhavenma

How To Pay Your Motor Vehicle Excise Tax Boston Gov

News Flash Middleton Ma Civicengage

Do You Report Paid Excise Tax In Massachusetts

Jeffery Jeffery Deputy Tax Collectors Massachusetts

![]()

Federal Excise Tax Receipts Way Down In April

Massachusetts Enacts Pte Elective Excise As Workaround To 10k Salt Cap Tonneson Co

Fillable Online Application For Abatement Of Motor Vehicle Excise Tax Fax Email Print Pdffiller

A Guide To Your Annual Motor Vehicle Excise Tax Wwlp

2021 Motor Vehicle Excise Tax Bills Fairhavenma

2022 Motor Vehicle Excise Bills Issued 3 3 2022 Due 4 4 2022 Rutland Ma